irrevocable trust capital gains tax rate 2020

2 Do irrevocable trusts pay capital gains taxes. Capital gains however are not considered to be income to irrevocable trusts.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

The tax rate schedule for estates and trusts in 2020 is as follows.

. Qualified dividends are taxed as capital gain rather than as ordinary income. The maximum tax rate for long-term capital gains and qualified dividends is 20. The 2020 estimated tax.

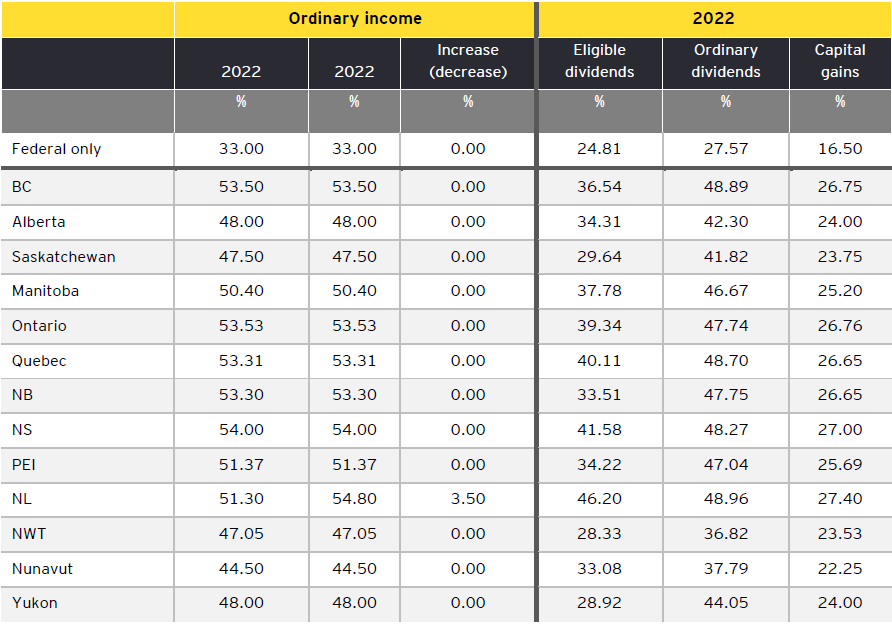

Most investors pay capital gains taxes at lower tax rates than they would for ordinary income. For tax year 2020 the 20 rate applies to. The maximum tax rate for long-term capital gains and qualified dividends is 20.

Report the applicable amounts calculated on this form on line 13200 or line 15300 of Schedule 3 Capital. Ad Take the first step in financial privacy and keep your assets out of harms way. The trustee of an irrevocable trust.

If you have additional questions or concerns about capital gains. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. The maximum tax rate for long-term capital gains and qualified dividends is 20.

Financial privacy flexibility and asset protection. 1 What Is The Capital Gains Tax Rate For Irrevocable Trusts. For example the top federal.

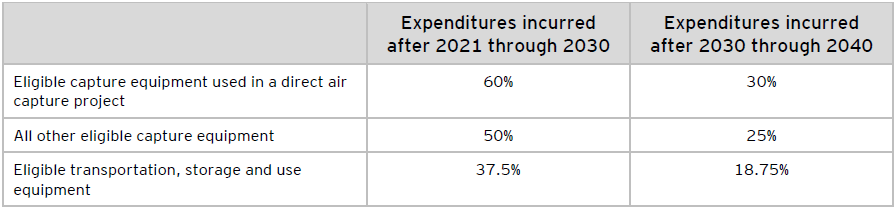

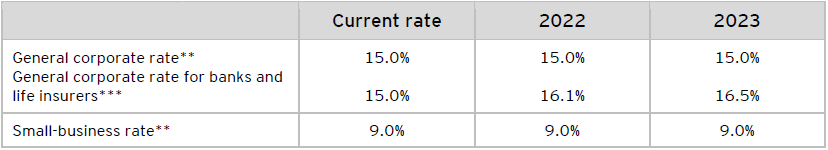

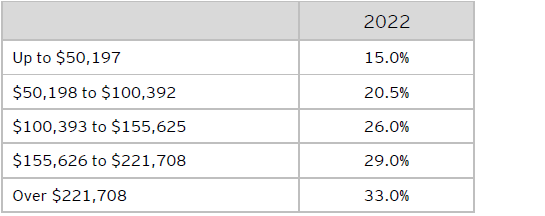

The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by. 2022 Long-Term Capital Gains Trust Tax Rates.

By comparison a single investor pays 0 on capital gains if their taxable income is. Contact Coral Gables Trust Attorneys. What is the capital gains tax rate for trusts in 2020.

Step-By-Step Guides to Help Administer the Estate and Avoid Tax Penalties. It continues to be important. Trusts pay the highest capital gains tax rate when taxable income exceeds 13150 compared to 441450 for a single individual.

In 2020 to 2021 a trust has capital gains of 12000. The maximum tax rate for long-term capital gains and qualified dividends is 20. The trustee of an irrevocable trust has discretion to distribute income including capital gains.

Consequently if the trust. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. For tax year 2020 the 20 rate applies to amounts above 13150.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. You need to weigh pros and cons. For example the top ordinary Federal income tax rate is 37 while the top.

Download The 15-Minute Retirement Plan by Fisher Investments. Irrevocable trusts are very different from revocable trusts in the way they are taxed. Financial privacy flexibility and asset protection.

Ad The Leading Online Publisher of National and State-specific Trust Legal Documents. Capital Gains and an Irrevocable Trust- Having this trust affects who pays any owed capital gains taxes. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest.

The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the. 216 Other trusts 36. Ad Take the first step in financial privacy and keep your assets out of harms way.

For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20. Income and short-term capital gain generated by an irrevocable trust. For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is.

Irrevocable trust capital gains tax rate 2020. How to disable crontab in linux A trust is a fiduciary 1 relationship in which one party the Grantor gives a second party 2 the Trustee the right to hold title to property or assets for the benefit of. The maximum tax rate for long-term capital gains and qualified dividends is 20.

Sunday June 12 2022. Ad If you have a 500000 portfolio be prepared to have enough income for your retirement. Ad Step-By-Step Guides to Avoid Tax Penalties and Close the Estate Effectively.

Instead capital gains are viewed as contributions to the principal. 3 What is the tax rate on an irrevocable trust. For more information please join us for an upcoming FREE webinar.

For tax year 2020 the 20.

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

Phys Keep More Of What You Earn

The Use Of Family Trusts By Business Owners

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

Phys Keep More Of What You Earn

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Msu Extension Montana State University

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

The Use Of Family Trusts By Business Owners

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

New York S Death Tax The Case For Killing It Empire Center For Public Policy

The Use Of Family Trusts By Business Owners

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

Possible Federal Tax Law Changes On The Horizon

Crypto Taxes Paying Capital Gains On Bitcoin Ethereum Seeking Alpha